A better understanding of Crypto Assets

Blockchain is a system in which a trail of transactions made in Bitcoin or another cryptocurrency are maintained across multiple computers that are linked in a peer-to-peer (P2P) network. It provides a channel to obtain evidence of transactions. Blockchain and other distributed ledger technologies are likely to radically change the financial eco-system as virtual assets become widely available and are now being used as payment products, hence the need for risk and compliance professionals to understand these new technologies and criminal behaviors better in the ever-transforming cryptosphere.

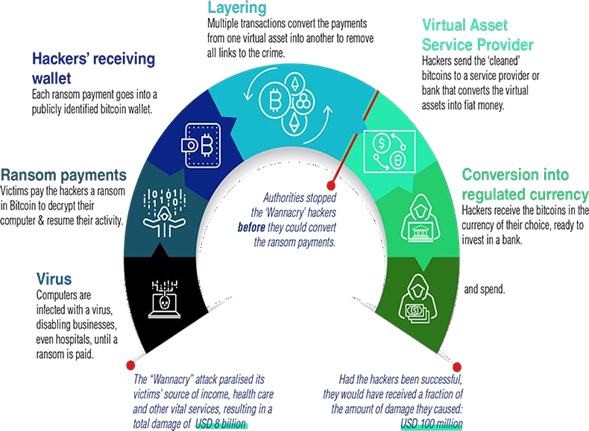

HOW CRIMINALS CAN ABUSE VIRTUAL ASSETS

“In 2017 the ‘Wannacry’ ransomware attack held thousands of computer systems hostage until the victims paid hackers a ransom in bitcoin. The cost of the attack went far beyond the ransom payments, it resulted in an estimated USD 8 billion in damages to hospitals, banks and businesses across the world. Other ransomware attacks have happened since and appear to be on the rise.”

Source: https://www.fatfgafi.org/publications/virtualassets/documents/virtualassets.html

VIRTUAL ASSET – THE CHALLENGE

Whilst some countries have started regulating virtual assets, others have prohibited virtual assets altogether, however, to date most countries have not regulated the environment and hence, the gaps in the global regulatory system continue to create significant openings for terrorists and criminals to abuse.

VIRTUAL ASSET – RED FLAGS

The financial industry, from banking to insurance and investment houses are vulnerable to frauds and scams where fraudsters prey on people who are less aware of the virtual universe. Trends to identify potential scams and frauds include, but not limited to, an exponential rise in prices, unrealistic promises, validation requests through coins, dodgy behaviours on social media handles and forceful YouTube accounts promoting a new coin. Don’t get lured in by these false promises – If something is too good to be true in appearance, it probably is too good to be true in reality!

To assist risk and compliance professionals to better understand the risks and mitigation methods required to deal with virtual eco-system, CISA will be launching a new training intervention shortly deep diving into this world – watch out for the launch.

ANTI-FINANCIAL CRIME (AFC) TRAINING PROGRAMME

At CISA we aim to provide meaningful insights and share real life experiences related to a variety of topics, with the first training intervention launching on 5th July 2022 covering Money Laundering & Illicit Financial Flows - Emerging trends in the Financial Sector.

FINANCIAL CRIME RISK ASSESMENT AND ACCEPTANCE

We are also in the process of finalizing the following modules as part of the Anti-Financial Crime training

programme which will cover foundational topics including:

- Identifying and assessing risks and the risk elements

- Managing the Key Risk Elements

- Assessment Methodologies, ML/TF/PF Risk and Compliance Risk

- ML/TF/PF Risk and Compliance Risk

Article written by Lynn Davidson Head: Risk & Governance at Converge Solutions (Pty) Ltd

CIsa News Letter Issue 2-A BETTER UNDERSTANDING OF CRYPTO ASSETS.pdf